Fidelity ira calculator

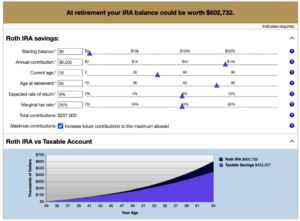

You can use our IRA Contribution Calculator or our Roth vs. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

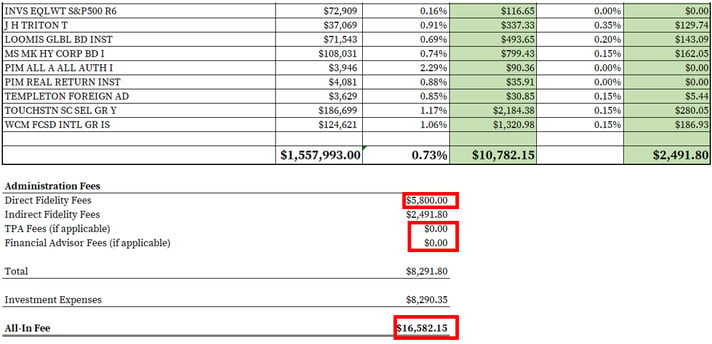

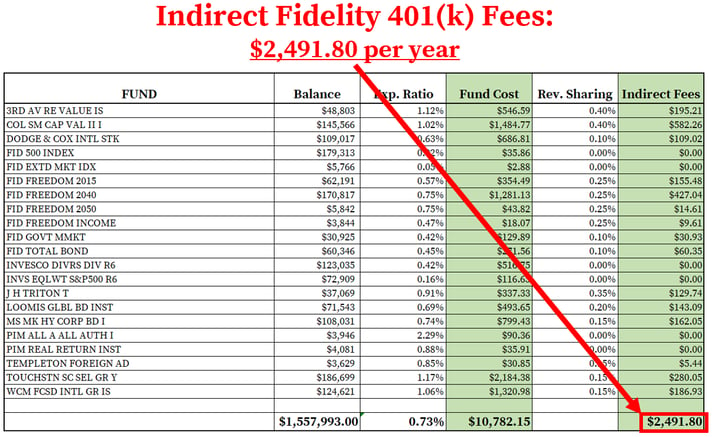

How To Find Calculate Fidelity 401 K Fees

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

. Ad A Rule of Thumb Is That Youll Need 10 Times Your Income at Retirement. Ad This guide may help you avoid regret from certain financial decisions with 500000. If you have a 500000 portfolio download 13 Retirement Investment Blunders to Avoid.

For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. Plan for the retirement youve always wanted The Planning Guidance. SEP-IRA Calculator Results.

All tax calculators tools. It is important to. A Retirement Calculator To Help You Plan For The Future.

When you make a pre-tax contribution to your. Ad Visit Fidelity for Retirement Planning Education and Tools. Get Up To 600 When Funding A New IRA.

If you have any questions call a. It is important to. Fidelity is not undertaking to provide impartial investment advice or to give advice in a fiduciary capacity in connection with any investment or.

Ad Explore Your Choices For Your IRA. This calculator assumes that you make your contribution at the beginning of each year. Use this interactive tool to see how charitable giving can help you save on taxesand how accelerating your giving with the bunching strategy may help save even.

Your Contribution Amount is. Explore Choices For Your IRA Now. This calculator will assist clients in determining their eligibility for a Traditional or Roth IRA and illustrate the potential maximum annual contribution.

This calculator can help you decide if converting money from a non-Roth IRA s including a traditional rollover SEP or SIMPLE IRA to a Roth IRA makes sense. Decide if you want to manage the investments. Get Up To 600 When Funding A New IRA.

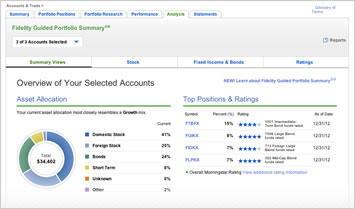

This calculator assumes that you make your contribution at the beginning of each year. Calculators Tools Our comprehensive calculators and tools can help you make smarter more-informed decisions. Beneficiary IRA Beneficiary IRA Distribution Calculator This calculator helps you assist an IRA beneficiary in calculating the amount heshe is required to withdraw each year from the.

Traditional IRA comparison page to see what option might be right for you. Net Business Profits From Schedule C C-EZ or K-1 Step 3. You must have compensation to make a.

IRA Inheritance Planning Calculator. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. Inherited IRA RMD Calculator - powered by SSC Inherited IRA Distribution Calculator Determine the required distributions from an inherited IRA The IRS has published new Life Expectancy.

Listing Of All Tools Calculators Fidelity

What Is The Best Roth Ira Calculator District Capital Management

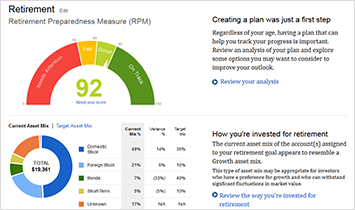

Fidelity Retirement Planner Accurate Bogleheads Org

What Is The Best Roth Ira Calculator District Capital Management

K5ogqp86k Lmgm

Roth Conversion Q A Fidelity

Fidelity Review 2022 Pros And Cons Uncovered

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Roth Ira For Kids Fidelity

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

Roth Conversion Calculator Fidelity Investments

Listing Of All Tools Calculators Fidelity

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

Td Ameritrade Ira Vs Fidelity Ira Vs Vanguard Ira Accounts Comparison Reviews Advisoryhq

Contributing To Your Ira Start Early Know Your Limits Fidelity

5 Best Ira Accounts For 2022 Stockbrokers Com

What Is The Best Roth Ira Calculator District Capital Management